top of page

Research | Brand design | Prototyping | User testing | UI

master's final project

2024

Bezalel

A comprehensive system of tools including Instagram content, WhatsApp group learning, website resources, and physical bar events. This case study focuses specifically on the digital game component

הכות

The Problem

Israeli young adults have dangerously low financial literacy rates.

Only 57% possess basic financial knowledge compared to 67% OECD average.

The target demographic actively avoids pension-related conversations, describing them as "scary" and "boring."

Key Insights from Research:

-

"Finance is interesting but frightening" - Age 25, Student

-

"There's huge pressure on this decade of life" - Focus group participant

-

Current financial education tools don't speak their language or address their mindset

Design Process

1. Research & Discovery

-

17 personal interviews with target demographic

-

102 survey responses analyzing financial behaviors

-

3 expert lectures on financial products

-

Competitive analysis of existing financial education tools

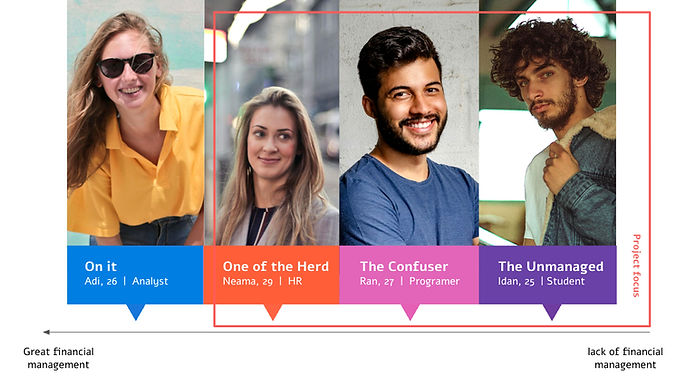

2. User Personas Identified

סדנא

"One of the Herd" (Naama, 29)

-

Relies 100% on employer for financial management

-

Passive approach to personal finance

"The Confused" (Ran, 27)

-

Thinks he knows but information is incorrect

-

Overconfident yet dangerous financial decisions

"The Unmanaged" (Idan, 25)

-

No stable employment framework

-

Unaware of existing financial products

-

Paralyzed by perceived complexity

The Digital Game Solution

Design Rationale

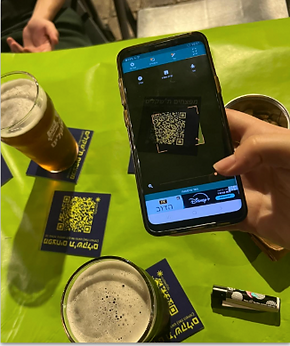

While the full system includes multiple touchpoints (Instagram, WhatsApp, website, bar events), the digital game serves as a crucial bridge between physical and digital experiences. It captures users in their natural social environment and guides them into the structured learning ecosystem.

Why a drinking game?

-

"If the mountain won't come to Muhammad..." - meet users where they are

-

Removes the intimidating context of traditional financial education

-

Creates positive associations with money conversations

-

Encourages healthy peer discussions about finance

-

Connects seamlessly to other system components

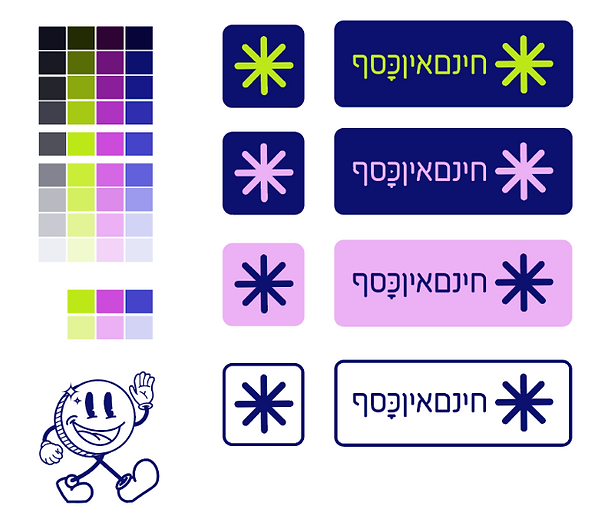

UI Design Principles

-

Young & Fresh: Vibrant color palette appealing to 20-30 demographic

-

Approachable: Non-intimidating interface that reduces financial anxiety

-

Nostalgic Elements: Vintage-style coin illustrations reminiscent of classic arcade games

-

Playful Typography: Modern fonts that feel conversational, not corporate

Game Flow

-

QR Code Scan: Users scan coaster while socializing

-

Onboarding: Quick, engaging introduction to pension basics

-

Interactive Questions: Gamified financial literacy challenges

-

Real-time Feedback: Immediate explanations and tips

-

Call-to-Action: Direct path to WhatsApp group for deeper learning

Key Design Decisions

1. Vintage Coin Aesthetic

Rationale: The retro coin design creates familiarity while making abstract financial concepts tangible. The "old-school" aesthetic appeals to nostalgia while feeling trustworthy.

2. Mobile-First Approach

Rationale: Bar environment requires seamless mobile experience. Large touch targets and simple navigation essential for social settings.

3. Micro-Learning Format

Rationale: Bite-sized information prevents cognitive overload. Each interaction teaches one specific concept about pension savings.

4. Social Integration

Rationale: Peer learning more effective than individual study. Game encourages group participation and discussion.

*Illustration by Omer Nachmias

bottom of page